Rental income tax in Kenya [Meaning, calculation and payment]

Rental income tax is a tax payable on income from rental property (both commercial and residential rental income).

Two regimes of accounting for rental income took effect in January 2016.

One is the monthly rental return and the other is the yearly income return.

The monthly rental return is for residential rental income with turnover equal to or less than Ksh. 15 million annually while the yearly income return regime is for commercial rent and residential rent turnover exceeding Ksh. 15 million.

The monthly rental income (MRI) is charged at the rate of 10% of the gross receipts and submitted and paid on monthly basis on or before the 20th day of the following month.

If you want to know how to file and pay your monthly rental return, follow the step-by-step guide with photos. You can also get an expert from Kreston KM to file the returns for you.

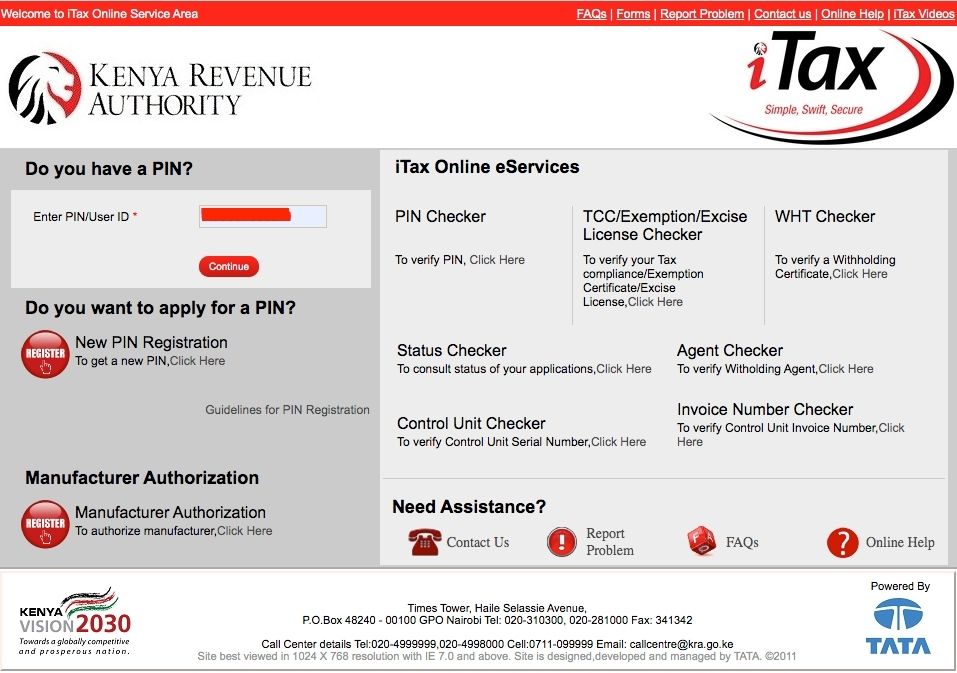

Step 1: Go to the iTax portal, enter your KRA PIN, press continue, input your password, complete the arithmetic question and security stamp check, then click on “Log in”.

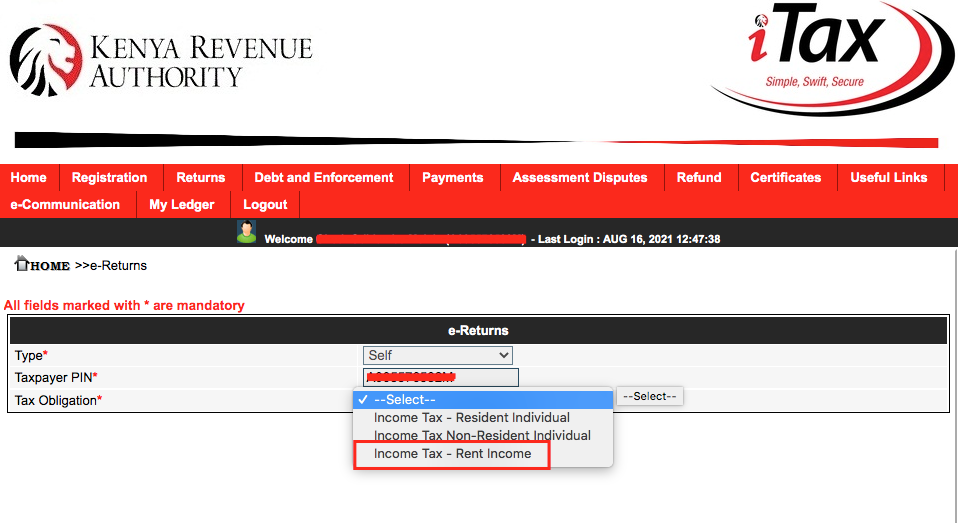

Step 2: After login in, go to the “Returns” menu and click on “File returns”.

Step 3: Select “Rent income” in the dropdown menu and click “Next”.

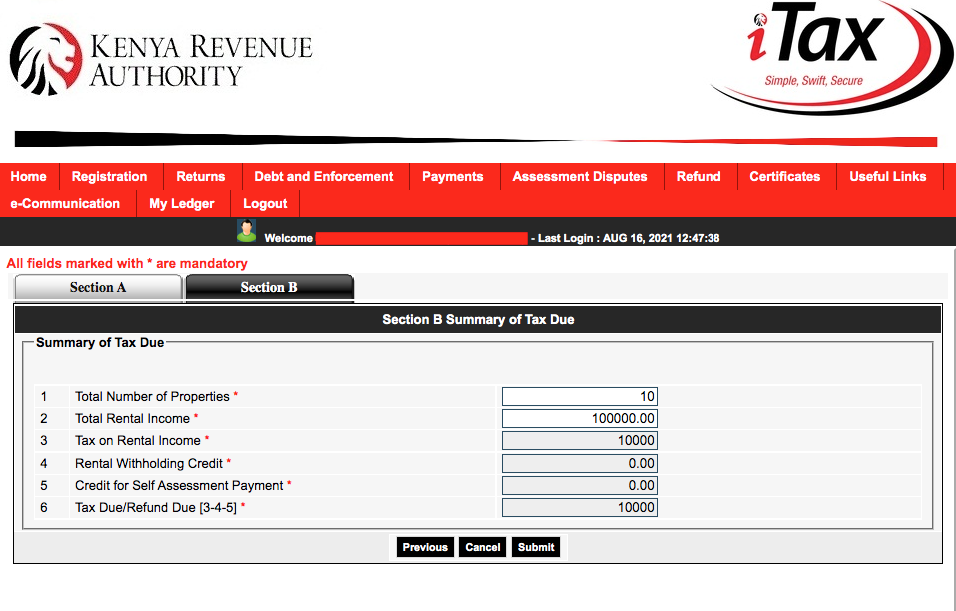

Step 4: Click on the “Section B” tab, fill in the number of units and total rental income, then submit. Once submitted the filling is complete.

Step 5: To pay, go to the “Payment” menu, then “Payment registration” and click “Next”.

Step 6: Select tax head as “income tax”, subhead as “income tax-rent income”, payment type as “self-assessment”, the tax period for the period you wish to pay i.e. July 2021, highlight the tax liability, and “add”. Select mode of payment through the dropdown as either, “other payment modes “ for cheque, cash, or mobile money.

Step 7: Finally, submit and reprint the payment slip for payment.

We’ve included screenshots of the steps.

If you still find it challenging to file your rental income tax, contact us for professional help.

![Installment tax [Definition, calculation, and payment]](https://www.krestonkm.com/wp-content/uploads/2021/08/installment-tax-in-kenya-768x403.jpg)